For more creative videos, check out Grey's Blog.

Sunday, December 4, 2011

Death to Pennies Video

This video has been posted on several other economics blogs, but in case you missed it...

For more creative videos, check out Grey's Blog.

For more creative videos, check out Grey's Blog.

Friday, December 2, 2011

Unemployment Paranoia: Job Market Report

When I was a senior at BU preparing to graduate in 2009 (arguably one of the worst years to graduate from college in the last few decades), for some strange reason I was not very worried about getting a job, at least that's how I remember it. I was either too optimistic, too confident, or I just didn't pay much attention to the doomsday headlines at the time.

Now that I am a few years older (and presumably wiser?), the job market is actually starting to worry me some. With student loan interest from undergrad accumulating on me while I am in graduate, I can hear the clock ticking on me.

I've heard a variety of things about current job market conditions, but it seems to me the underlying feeling that most people have is that the job market is tougher than ever and options are slimmer than ever. People are taking second tier or part-time jobs until better positions open up elsewhere. Throngs of recent college grads are moving in with their parents. Here are some more doom and gloom unemployment stories if you really want to get depressed.

Is my new-found paranoia about unemployment rational? Let's take a look at the data. The graph below, and several others I have posted in the past (here and here), are quite worrisome.

Although the outlook is pretty bad for a lot of people right now, there are small signs of life in the labor market. The unemployment rate has been slowly ticking down since early the late 2009 / early 2010.

Job quits are also continuing to rise. Yes, more people quitting their jobs is actually a good thing. Rising job quits are typically associated with recoveries. People leaving a job may have done so because they feel confident about their other job options. This can be thought of as a signal that people are expecting more hiring in the labor market. Obviously high turnover can be bad for a particular company or organization, but in an economy, some amount of turnover is necessary so that labor markets can effectively match people with jobs that best use their skills.

The best news of all, it is well established that, on average, people with a college education or higher fare better in the labor market than those with less education. Although unemployment rates are up across the board, the unemployment rate for people with a bachelor's degree and higher is about 4% compared to 14% for people without a high school diploma. This is a always reassuring, even if the relationship isn't completely causal.

For more positive news about the most recent jobs numbers, I just found this jobs report from CNN. Things are looking up.

Now that I am a few years older (and presumably wiser?), the job market is actually starting to worry me some. With student loan interest from undergrad accumulating on me while I am in graduate, I can hear the clock ticking on me.

I've heard a variety of things about current job market conditions, but it seems to me the underlying feeling that most people have is that the job market is tougher than ever and options are slimmer than ever. People are taking second tier or part-time jobs until better positions open up elsewhere. Throngs of recent college grads are moving in with their parents. Here are some more doom and gloom unemployment stories if you really want to get depressed.

Is my new-found paranoia about unemployment rational? Let's take a look at the data. The graph below, and several others I have posted in the past (here and here), are quite worrisome.

|

Although the outlook is pretty bad for a lot of people right now, there are small signs of life in the labor market. The unemployment rate has been slowly ticking down since early the late 2009 / early 2010.

|

Job quits are also continuing to rise. Yes, more people quitting their jobs is actually a good thing. Rising job quits are typically associated with recoveries. People leaving a job may have done so because they feel confident about their other job options. This can be thought of as a signal that people are expecting more hiring in the labor market. Obviously high turnover can be bad for a particular company or organization, but in an economy, some amount of turnover is necessary so that labor markets can effectively match people with jobs that best use their skills.

|

The best news of all, it is well established that, on average, people with a college education or higher fare better in the labor market than those with less education. Although unemployment rates are up across the board, the unemployment rate for people with a bachelor's degree and higher is about 4% compared to 14% for people without a high school diploma. This is a always reassuring, even if the relationship isn't completely causal.

|

| *2011 unemployment rate through November 10th, 2011 |

Labels:

education,

employment,

labor,

unemployment

Thursday, December 1, 2011

Cyber Espionage

Cyber security precautions for a senior fellow at the Brookings Institution on his trips to China:

"I first of all get a loaner laptop. And the USB that I bring, I clean digitally before I bring it, so it's totally blank," Lieberthal says.

Lieberthal then disconnects the Wi-Fi and Bluetooth functions, sets email filters and a virtual private network, or VPN. That's all before the trip. While in China, he never lets his Blackberry leave his side, never uses a wireless Internet connection while he has his USB drive plugged in, and he also physically hides his fingers when typing passwords.

When he gets home, everything gets digitally wiped and cleaned.

Why take all this precaution? Espionage. More specifically, cyber-espionage.At first I thought this was overkill, until I looked up Lieberthal, who is an expert on US-China foreign policy. Interesting story throughout. Government and private sector snooping is probably more pervasive than most of us realize.

Labels:

China,

technology

Wednesday, November 30, 2011

Charter School Growth

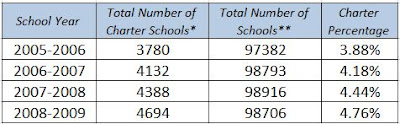

Yesterday, I wrote about some key questions facing the charter school movement. I starting thinking about how important these questions are in terms of the structure of our public education system. Here is what I dug up.

Data for 2009-2010 and 2010-2011 were unavailable. The percentage of total schools that are classified as charter schools is increasing by about .29% per year. This means that in 2011-2012, charters are projected to be about 5.63% of all operational schools (assuming a linear trend). This is a relatively small proportion of the total, but certainly more than just a drop in the bucket. And this proportion is growing larger each year.

In fact, charter schools have more than doubled since 2000, whereas the total number of operational schools has grown by about 10% over the same time frame. This impressive growth shows that charter schools have gained traction. Serious work needs to be done to analyze the charter model and how it can successfully be scaled up.

Data sources:

*Source: Table 100. Number and enrollment of public elementary and secondary schools, by school type, level, and charter and magnet status: Selected years, 1990-91 through 2008-09

http://nces.ed.gov/programs/digest/d10/tables/dt10_100.asp

**Source: NCES Common Core of Data (CCD), "Public Elementary/Secondary School Universe Survey"

http://nces.ed.gov/ccd/bat/

Data for 2009-2010 and 2010-2011 were unavailable. The percentage of total schools that are classified as charter schools is increasing by about .29% per year. This means that in 2011-2012, charters are projected to be about 5.63% of all operational schools (assuming a linear trend). This is a relatively small proportion of the total, but certainly more than just a drop in the bucket. And this proportion is growing larger each year.

In fact, charter schools have more than doubled since 2000, whereas the total number of operational schools has grown by about 10% over the same time frame. This impressive growth shows that charter schools have gained traction. Serious work needs to be done to analyze the charter model and how it can successfully be scaled up.

Data sources:

*Source: Table 100. Number and enrollment of public elementary and secondary schools, by school type, level, and charter and magnet status: Selected years, 1990-91 through 2008-09

http://nces.ed.gov/programs/digest/d10/tables/dt10_100.asp

**Source: NCES Common Core of Data (CCD), "Public Elementary/Secondary School Universe Survey"

http://nces.ed.gov/ccd/bat/

Labels:

education

Tuesday, November 29, 2011

Questions about Charter Schools

A teacher friend recently sent me an Economist piece from 2009 about charter schools. Several extremely successful charters such as KIPP and Uncommon Schools have received a lot of press. However, the jury is still out on charter schools as a whole as much of the research is mixed about their overall impact. Below are two particularly relevant questions about charter schools that I believe are still unanswered today.

If charter schools are teaching a narrow curriculum and focusing on test preparation, that should become clear when data are gathered on high-school completion rates and college destinations. If they are excluding lots of pupils, that will be obvious too. And if the state education department co-operates by giving researchers access to data on its own pupils, it will be possible to tell whether charter schools are leaching talent from state schools—or whether the challenge they pose to incumbents improves performance across the board.

[...] The final charge against schools such as those run by KIPP is that their longer hours and the demands those place on teachers make them impossible to sustain, let alone replicate.I am not proposing that I know the answers to these questions. I am simply recognizing that the area needs more research along with more time to follow the outcomes of the growing cohorts of "charter students".

Labels:

education

Sunday, November 27, 2011

2 Free MP3s from Amazon (Students Only)

Amazon is currently offering 2 free MP3 downloads for students. Worth checking out as they have a large selection second only to iTunes. Also worth checking out is this comparison of Google Music, iTunes, and Amazon Cloud player. The legal online music space is finally getting crowded. Will iTunes' prices eventually fall with the increased competition or are there substantial switching costs involved?

Wednesday, November 16, 2011

Tennessee Teachers Get to Play the Odds in the Evaluation Game

I will preface this post for anyone that is not aware. I taught high school math in Nashville, Tennessee for the last two years in the public school system.

I will preface this post for anyone that is not aware. I taught high school math in Nashville, Tennessee for the last two years in the public school system. Tennessee is implementing a new teacher evaluation system this year. A NY Times article titled In Tennessee, Following the Rules for Evaluations Off a Cliff discusses the shortfalls of the new teacher evaluation system. I am aware of the challenge of measuring student achievement in classes like art, band, dance, and other subjects that don't have state tests, but this part surprised me:

For 15 percent of their testing evaluation, teachers without [test] scores are permitted to choose which subject test they want to be judged on. Few pick something related to their expertise; instead, they try to anticipate the subject that their school is likely to score well on in the state exams next spring.And more...

It’s a bit like Vegas, and if you pick the wrong academic subject, you lose and get a bad evaluation. While this may have nothing to do with academic performance, it does measure a teacher’s ability to play the odds.Although a learning curve is to be expected for states implementing new evaluation systems, allowing teachers of non-tested subjects choose which subject test they will be judged on is just a horrible idea. This blatantly bad policy needs to be scrapped, and the state department needs to go back to the drawing board. Why evaluate teachers on how their students do in ANOTHER subject? They have less incentive to teach THEIR subject well.

Sidenote: I am glad I'm not teaching right now in TN.

HT M.S.

Labels:

education,

incentives,

policy

Where did all the jobs go...and when are they coming back?

More evidence that the most recent recession/recovery is a of a different nature than most. This graph shows the percent decline in employment levels over time for each recession since 1948. Not only has the 2008 recession had the greatest percentage decline, but it also appears that we will not return to the prerecession peak for some time. Notice the shape of the 2001 and 2008 trends vs the rest of the recessions shown. 2001 was not nearly as deep as some of the others, but it took a lot of time to get back to the previous peak. It looks like the Great Recession got the worst of both worlds.

Here is the original graph from McKinsey. They suggest an alarming trend, but I am waiting to see what happens in the next recession (although I'm hoping that isn't for at least another 10 years. If it is also followed by a jobless recovery, then I'll agree we are in serious trouble.

See my previous posts about the jobless recovery here and here. I'm not actively in the job market right now, but is anyone seeing signs of life out there?

HT D.O

Here is the original graph from McKinsey. They suggest an alarming trend, but I am waiting to see what happens in the next recession (although I'm hoping that isn't for at least another 10 years. If it is also followed by a jobless recovery, then I'll agree we are in serious trouble.

See my previous posts about the jobless recovery here and here. I'm not actively in the job market right now, but is anyone seeing signs of life out there?

HT D.O

Labels:

employment,

labor,

recession,

recovery,

unemployment

Wednesday, November 2, 2011

Quote of the Day

"All models are wrong, some are useful."

- George E.P. Box, Industrial Statistician

- George E.P. Box, Industrial Statistician

Friday, October 28, 2011

Forgiving Student Loan Debt - A Good Or Bad Idea?

This idea has been floating around the internet for a couple of months. My thoughts? One of the worst ideas ever. Although I have a pile of student loans myself, and I would benefit greatly from a policy like this, I can see how inane this idea actually is. Here is Justin Wolfers on why this idea sucks.

Addendum: I found this piece from the Economist discussing student loan forgiveness.

Addendum: I found this piece from the Economist discussing student loan forgiveness.

Many of the anti-Wall Street protesters push the idea of blanket debt forgiveness as a solution. But that is the wrong answer. Higher education is not a guarantee of employment, but it improves the odds immensely. Unemployment rates among university graduates stood at 4.4% on average across OECD countries in 2009. People who did not complete secondary school faced unemployment rates of 11.5%. Much of the debt that students are taking on is provided or guaranteed by the government. Imposing write-offs on all taxpayers to benefit those with the best job prospects is unfair; and ripping up contracts between borrowers and private lenders is usually a bad idea.I could not agree more. The article goes on to discuss why student loan laws need to be changed in order to ease the burden of student loans in times of economic crisis.

Labels:

education,

incentives,

policy

Wednesday, October 26, 2011

It's All Relative - The 2009 Recovery

Here is an informative graphic from the WSJ comparing the recent recovery to all other recoveries since WWII. (Click the picture to enlarge.)

There are several striking things about the recovery that started in June 2009. It is a jobless recovery, bank lending is abnormally low, home prices have tanked (and are continuing to decline on average), and disposable personal income is recovering more slowly than in all previous post-WWII recoveries. I know the graphic is from several months ago, but I believe that most of these general trends have not changed much since then.

HT Dr. Snowden for sharing these graphs to motivate discussion of business cycle theory.

There are several striking things about the recovery that started in June 2009. It is a jobless recovery, bank lending is abnormally low, home prices have tanked (and are continuing to decline on average), and disposable personal income is recovering more slowly than in all previous post-WWII recoveries. I know the graphic is from several months ago, but I believe that most of these general trends have not changed much since then.

HT Dr. Snowden for sharing these graphs to motivate discussion of business cycle theory.

Tuesday, October 25, 2011

College Football Predictions

The Harvard College Sports Analysis Collective (HSAC) released predictions on Sunday for what they thought the AP Poll would look like when released on Monday morning. And their prediction model did fairly well:

My intuition is that their predictions would be less accurate the first half of the season as the best teams start to have not yet proven themselves in voters' minds (voters being sportswriters and coaches). Toward the end of the season, I would guess that these predictions would have greater precision as teams have largely sorted themselves by that point and voters have more data (wins, loses, points per game, opponent points per game, etc.) to base their rankings on. This is simply a hypothesis, but worth looking into.

HT John M. for sharing this post

Our predictions did well, accurately predicting the exact ranking of 11 teams. That is not counting minor mis-orderings, like the Wisconsin-Kansas State-Oklahoma triad. We struggled a bit at the bottom of the poll, as we suspected.

Finally, the correlation between the predicted points for each team and the actual points was an amazing 0.985.These are pretty impressive results given that the AP Poll is based on somewhat subjective human voting behavior. Since this is just one random week taken from the "population," I would be even more interested to see how well HSAC's predictions hold up over an entire season. I've commented on their post with this question, and am currently waiting for a response.

My intuition is that their predictions would be less accurate the first half of the season as the best teams start to have not yet proven themselves in voters' minds (voters being sportswriters and coaches). Toward the end of the season, I would guess that these predictions would have greater precision as teams have largely sorted themselves by that point and voters have more data (wins, loses, points per game, opponent points per game, etc.) to base their rankings on. This is simply a hypothesis, but worth looking into.

HT John M. for sharing this post

Labels:

data,

econometrics,

predictions,

Sports

Friday, October 21, 2011

MIT Sloan Sports Analytics Conference

|

| Source: http://www.sloansportsconference.com |

Once again, they have an all-star lineup of guest speakers including Bill Simmons (The Sports Guy), Eric Mangini, Jeff Van Gundy, Mark Cuban, Michael Wilbon, and many others.

My goals for the conference include learning more about sports analytics, finding out what career opportunities exist for economists who want to work in sports, and networking with people in the business and with other students like myself. I also hope to make some time to return to my stomping grounds at Boston University. If there is enough time after all of that, I'll squeeze in a blog post or two with updates and reflections.

This year should be especially interesting with the NBA season currently at risk and lots of discussion of the NCAA.

Update: There is a tentative NCAA panel that the SSAC is working on putting together.

Second Update: The Father of "Sabermetrics," Bill James, will be speaking.

Labels:

Sports

Thursday, October 13, 2011

The State of India's Educational Attainment

The excerpts below are from a paper by economists Barry Bosworth and Susan Collins when they were both research fellows at the Brookings Institution a few years ago (Bosworth is still there).

India clearly started the race a few strides back in 1960, and they still have a lot of ground to make up moving forward. While average years of schooling increased, and the share of their population without schooling decreased significantly, India still had almost 3 times as much of their population with no schooling relative to China. The authors also cite a literacy rate of just 76% among youth aged 15-24 in India compared to a 99% literacy rate for China (p.52).

Taking the state of India's education as given, the authors suggest the following.

Over the long run, education is key. In the race to educate, India still has some catching up to do. If they can accelerate the rate of progress they have made in education over the last 40 years, then economic growth will be sustainable for years to come.

[...] 98 percent of China’s primary school enrollees reach the fifth grade, compared to 60 percent for India. Despite an external reputation for having a large pool of highly educated persons, India faces serious deficiencies in the education of the bulk of its youth population (p. 63).Before reading this article, my perceptions of India matched the "external reputation" described above. However, the data do not lie. The following table from the paper (p.52) compares India to their "peer group."

India clearly started the race a few strides back in 1960, and they still have a lot of ground to make up moving forward. While average years of schooling increased, and the share of their population without schooling decreased significantly, India still had almost 3 times as much of their population with no schooling relative to China. The authors also cite a literacy rate of just 76% among youth aged 15-24 in India compared to a 99% literacy rate for China (p.52).

Taking the state of India's education as given, the authors suggest the following.

Ultimately, India will need to redress its inadequate infrastructure and to broaden its trade beyond the current emphasis on services. Only an expansion of goods production and trade can provide employment opportunities for its current pool of underemployed and undereducated workers (p. 64).The moral of the story? India needs to utilize it's workforce better in the short to medium run given where they currently stand. They can do this by ramping up industrial production and trade, a traditional source of growth for developing nations.

Over the long run, education is key. In the race to educate, India still has some catching up to do. If they can accelerate the rate of progress they have made in education over the last 40 years, then economic growth will be sustainable for years to come.

Wednesday, October 12, 2011

Koomey's Law vs. Moore's Law

For some time I've been fascinated by laws that scientists, economists, and other social scientists come up with that accurately describe relationships that occur in the world around us. Moore's law is one of those laws that has had exciting implications in the field of technology. Most people have heard of Moore's Law, but in case you haven't, here's what Investopedia has to say about it:

A new finding by Stanford professor Jonathan Koomey could become the new Moore's Law. The gist of the Koomey's law is that the energy efficiency of computers doubles every 1.5 years. This is an important finding! The chart below illustrates how historically strong the relationship is.

Ceteris paribus, Koomey's law means that that our laptops and devices will keep getting lighter and lighter as battery sizes will shrink... but will all else be equal? Probably not. Programs and data types are constantly requiring greater amounts of computing power, and thus more energy. Thus, batteries will likely shrink, but at a much slower rate than predicted by Koomey's law because of the demand for increases in computing power. Still exciting stuff though!

*Note, I'm aware that Koomey's finding is not officially a law yet. But, it's much easier to call it Koomey's law than Koomey's finding. When does a finding actually become a "law" anyway?

**Eric Brynjolfsson, an MIT professor who blogs over at Economics of Information has a similar post on the topic.

An observation made by Intel co-founder Gordon Moore in 1965. He noticed that the number of transistors per square inch on integrated circuits had doubled every year since their invention. Moore’s law predicts that this trend will continue into the foreseeable future.

Although the pace has slowed, the number of transistors per square inch has since doubled approximately every 18 months. This is used as the current definition of Moore's law.While Moore's law has been amazingly accurate in describing the doubling of computing power over time (and has even become part of the planning process for technology companies), it may start fading away as physical limitations start to come into play. Opinions are mixed.

A new finding by Stanford professor Jonathan Koomey could become the new Moore's Law. The gist of the Koomey's law is that the energy efficiency of computers doubles every 1.5 years. This is an important finding! The chart below illustrates how historically strong the relationship is.

|

| Source: The Economist Daily Chart |

*Note, I'm aware that Koomey's finding is not officially a law yet. But, it's much easier to call it Koomey's law than Koomey's finding. When does a finding actually become a "law" anyway?

**Eric Brynjolfsson, an MIT professor who blogs over at Economics of Information has a similar post on the topic.

Labels:

innovation,

laws of behavior,

technology

Wednesday, October 5, 2011

1800's Harvard Exam

This old-school Harvard exam from the 1800s would have rocked my socks. Lot's of Latin and computational math problems. At first glance, I thought the word "rod" was a typo (arithmetic, question 6). Then I looked it up. Apparently, 1 square rod = 30.25 square yards. I guess they stopped teaching that measurement in school.

HT Mitchell for sharing this.

|

| Click the picture to access the exam |

HT Mitchell for sharing this.

Tuesday, October 4, 2011

Denmark's "Fat Tax" and Unintended Consequences

Denmark's "fat tax" went into effect on Saturday. Denmark is apparently the only country with such a tax. Via The LA Times.

In addition to the potential unintended consequences, there will be significant costs associated with enforcement, data collection, processing, etc. The tax is relatively complicated which means even higher costs to the system. Via the Washington Post:

Regardless of the associated costs of the fat tax, Danish lawmakers believe this is essential, and they passed the law with relative ease. The big question is will the fat tax do what it is designed to do, increase the average Danish lifespan and help the Danes catch up with the OECD average? This has yet to be seen, but I am doubtful.

Here is the NPR story where I originally heard about the Danish fat tax.

The tax rate is 16 Danish kroner per kilogram of saturated fat in a food – in terms Americans can understand, that’s about $6.27 per pound of saturated fat – and it kicks in when the saturated fat content of a food item exceeds 2.3%.

[...] the tax adds 12 cents to a bag of chips, 39 cents to a small package of butter and 40 cents to the price of a hamburger.Here is why the tax has been enacted.

[...] Denmark lags in terms of life expectancy, and the country hopes the measure will increase the average lifespan by three years over the next decade.A respectable goal. Will the tax work? Via BBC News:

Some consumers began hoarding to beat the price rise, while some producers call the tax a bureaucratic nightmare. Others suggest that many Danes will simply start shopping abroad.These possibilities make clear the unintended consequences of policy. Will the "fat tax" impact public health and increase lifespans, or will it simply alter when and where consumers buy their fatty goods. Local entrepreneurs could capitalize on a this newly created opportunity to providing fatty goods at a slightly lower cost on the black market. German "fat shops" could pop up right across the border, selling candy, dairy, and snack foods at lower prices than what a Danish consumer could get in Denmark. There are also other reasonable scenarios where Danes could get around the tax. Consumers could shift their consumption to other unhealthy foods that have low fat, but high refined sugar and sodium content. Producers could innovate around the tax by manipulating fat contents by included other potentially harmful ingredients.

In addition to the potential unintended consequences, there will be significant costs associated with enforcement, data collection, processing, etc. The tax is relatively complicated which means even higher costs to the system. Via the Washington Post:

Linnet Juul says the tax mechanism is very complex, involving tax rates on the percentage of fat used in making a product rather than the percentage that is in the end-product.

As such, only the arrangements of how companies should handle the tax payments could cost Danish businesses about $28 million in the first year, he said.This number is obviously just an estimate, but the fat tax is going to be difficult to implement successfully and could cost businesses a substantial amount of money in terms of revenue and administrative costs (not to mention the cost to the government... although admittedly they could make a killing).

Regardless of the associated costs of the fat tax, Danish lawmakers believe this is essential, and they passed the law with relative ease. The big question is will the fat tax do what it is designed to do, increase the average Danish lifespan and help the Danes catch up with the OECD average? This has yet to be seen, but I am doubtful.

Here is the NPR story where I originally heard about the Danish fat tax.

Sunday, September 25, 2011

The Rule of 70

The Rule of 70 provides a quick and dirty method of calculating how long it will take an asset, economy, etc. growing at a constant growth rate to double in size.

This handy rule of thumb gives us a reasonable approximation of the length of time it would take something to double in size with a constant growth rate.

I put together an illustration of the rule of 70 concept in Excel. You can play around with the growth rate and see how the rule of 70 approximation compares to the actual time to double.

- If my savings grow at a 2% rate each year, it will take approximately 35 years for my savings to double.

- If a country's economy grows at 5% each year, it will take 14 years to double in size (in nominal terms).

- If a town's population is growing at 3.5% per year, it will take 20 years for the population to double

- If a tree grows 15% per year in height, it will take the tree about 5 years to double in height.

Over the next decade, Mr. Bogle said stocks are likely to generate an average annual return, including dividends, of around 7%. "Your money will double in 10 years," he said.

This handy rule of thumb gives us a reasonable approximation of the length of time it would take something to double in size with a constant growth rate.

I put together an illustration of the rule of 70 concept in Excel. You can play around with the growth rate and see how the rule of 70 approximation compares to the actual time to double.

Saturday, September 24, 2011

The Impact of Moneyball on the MLB

Yesterday, Skip Sauer, an economist from Clemson University, posted over at TSE about how the impact of Michael Lewis's Moneyball on Major League Baseball.

When Jahn Hakes and I embarked on our first academic paper on the subject, we thought there was a decent chance that we could refute the economic claims in Moneyball, in particular that players with high OBP were under-priced in the labor market. Any card-carrying economist knows this is inconsistent with equilibrium in a well-functioning, competitive labor market, and were not baseball teams intensely competitive? But instead, Jahn and I found that high OBP players did come cheap, relative to the contribution of their skill to winning baseball games. Intriguingly however, we found that the “OBP discount” vanished in 2004, the year that Moneyball was published. The likely reason: other teams, like Michael Lewis, had looked into what was going on in Oakland, and hired people out of the A’s front office. Now there were multiple bidders for high-OBP players in baseball’s labor market, thus driving up their price.OBP refers to on-base-percentage. And more from his second paper inspired by Moneyball.

In the early, pre-expansion period of 1986-1993, the estimated percentage boost in salary from a one standard deviation increase in the ability to take walks was a measly 2.8%. Post-Moneyball, the figure was 14.0%. The financial returns to the overlooked skill increased by a factor of five. Is that not indicative of a fundamental change in the game?Pretty impressive findings. I've been thinking about sports economics as a potential career for several years now. Perhaps this movie will generate some buzz and increase demand for people trained in economics, statistics, finance, and mathematics that want to work in professional sports for a career. Or even college sports for that matter. As someone who grew up in a great college town, I wonder about the extent to which big-time college football programs are actively implementing advanced statistical analysis to improve their teams.

Labels:

Sports

The Best American Sports Writing 2011 - FREE!

One of the most popular posts on this blog to date has been the The Best American Sports Writing 2010 - Free that I posted earlier this year. I guess people like free stuff. In that post, I linked to as many articles of the 2010 edition of the book as possible, since most of them could be found somewhere on the internet.

Well, I have done the same thing for the latest edition, The Best American Sports Writing 2011, which is coming out on October 4th. There are a few articles that I have not been able to locate yet, so if you are able to find them, let me know and I'll link to them here. If you prefer reading in book format, you can pre-order the book right now for $10 on Amazon for a both the paperback and Kindle editions. Enjoy!

Above and Beyond by Wright Thompson from ESPN.com

A Gift That Opens Him Up by Bill Plaschke from the Los Angeles Times

Well, I have done the same thing for the latest edition, The Best American Sports Writing 2011, which is coming out on October 4th. There are a few articles that I have not been able to locate yet, so if you are able to find them, let me know and I'll link to them here. If you prefer reading in book format, you can pre-order the book right now for $10 on Amazon for a both the paperback and Kindle editions. Enjoy!

Risks, Danger Always in Play by John Powers from the Boston Globe (subscriber access only)

Breathless 4 by Chris Jones from ESPN The Magazine

The Surfing Savant by Paul Solotaroff from Rolling Stone

School of Fight: Learning to Brawl with the Hockey, Goons of Tomorrow by Jake Bogoch from Deadspin.com

The Franchise by Patrick Hruby from ESPN.com

Eight Seconds by Michael Farber from Sports Illustrated (unable to locate)

The Surfing Savant by Paul Solotaroff from Rolling Stone

School of Fight: Learning to Brawl with the Hockey, Goons of Tomorrow by Jake Bogoch from Deadspin.com

The Franchise by Patrick Hruby from ESPN.com

Eight Seconds by Michael Farber from Sports Illustrated (unable to locate)

ABC News Investigation: USA Swimming Coaches Molested, Secretly Taped Dozens of Teen Swimmers by Megan Chuchmach and Avni Patel from ABCNews.com

Own Goal by Wells Tower from Harper’s Magazine

Culture of Silence Gives Free Rein to Male Athletes by Sally Jenkins from the Washington Post

High School Dissonance by Selena Roberts from Sports Illustrated

Gentling Cheatgrass by Sterry Butcher from Texas Monthly

Pride of a Nation by S. L. Price from Sports Illustrated

The Crash by Robert Sanchez from 5280

The Patch by John Mcphee from The New Yorker (subscriber access only)

Fetch Daddy a Drink by P. J. O'Rourke from Garden and Gun

Trick Plays by Yoni Brenner from The New Yorker

The Short History of an Ear by Mark Pearson from Sport Literate (unable to locate)

Pride of a Nation by S. L. Price from Sports Illustrated

The Crash by Robert Sanchez from 5280

The Patch by John Mcphee from The New Yorker (subscriber access only)

Fetch Daddy a Drink by P. J. O'Rourke from Garden and Gun

Trick Plays by Yoni Brenner from The New Yorker

The Short History of an Ear by Mark Pearson from Sport Literate (unable to locate)

If You Think It, They Will Win by Bill Shaikin from the Los Angeles Times (unable to locate)

The Dirtiest Player by Jason Fagone from GQ

Old College Try by Tom Friend from ESPN.com

Dusty Baker a Symbol of Perseverance by Howard Bryant from ESPN.com

Icarus 2010 by Craig Vetter from Playboy (not even going there)

The Dirtiest Player by Jason Fagone from GQ

Old College Try by Tom Friend from ESPN.com

Dusty Baker a Symbol of Perseverance by Howard Bryant from ESPN.com

Icarus 2010 by Craig Vetter from Playboy (not even going there)

Danny Way and the Gift of Fear by Bret Anthony Johnston from Men’s Journal

The Tight Collar by David Dobbs from Wired.com

Life Goes On by Mark Kram Jr. from the Philadelphia Daily News

The Courage of Jill Costello by Chris Ballard from Sports Illustrated

Life Goes On by Mark Kram Jr. from the Philadelphia Daily News

The Courage of Jill Costello by Chris Ballard from Sports Illustrated

Above and Beyond by Wright Thompson from ESPN.com

A Gift That Opens Him Up by Bill Plaschke from the Los Angeles Times

New Mike, Old Christine by Nancy Hass from GQ

I haven't had a chance to read any of the articles yet, but I'll update this post with my personal favorites when I do.

I haven't had a chance to read any of the articles yet, but I'll update this post with my personal favorites when I do.

Saturday, September 10, 2011

What is an economist? Cartoon Edition

This is the second post in the series "What is an Economist?"

I am re-posting this cartoon from Greg Mankiw's blog because I enjoyed it so much. I also thought it fit well with this series.

From time to time this cartoon will pop into my head during class as we are discussing spurious assumptions that are made for economic theories and models. One of the wonderful things about economics is that models are usually built off of "reasonable" assumptions and proven laws of economics. Then we see where those assumptions lead us. Hopefully to some conclusions that we can cleverly test with real-world data. If those assumptions turn out to be unreasonable or flat-out wrong, we should go back and adjust our models.

What this cartoon points out, I think, is a major problem in many fields, but specifically in econ. Economists must be willing to go back and adjust assumptions and models to conform to real-world data and observations... If the catapult doesn't work, maybe a better strategy structure would be a bridge!

I am re-posting this cartoon from Greg Mankiw's blog because I enjoyed it so much. I also thought it fit well with this series.

|

| Click picture to enlarge |

From time to time this cartoon will pop into my head during class as we are discussing spurious assumptions that are made for economic theories and models. One of the wonderful things about economics is that models are usually built off of "reasonable" assumptions and proven laws of economics. Then we see where those assumptions lead us. Hopefully to some conclusions that we can cleverly test with real-world data. If those assumptions turn out to be unreasonable or flat-out wrong, we should go back and adjust our models.

What this cartoon points out, I think, is a major problem in many fields, but specifically in econ. Economists must be willing to go back and adjust assumptions and models to conform to real-world data and observations... If the catapult doesn't work, maybe a better strategy structure would be a bridge!

Labels:

cartoon,

What Is An Economist?

Friday, September 9, 2011

The FRED Excel Add-In - Getting Economic Data Has Never Been Easier

Paul Krugman posted briefly on his blog last month about a free excel tool called the FRED add-in (Federal Reserve Economic Data). This tool by the St. Louis Fed is a simple, yet essential for anyone who likes working with and analyzing economic data. Basically, this excel add-in streamlines the process of downloading/importing economic data into a spreadsheet. And it fits nicely into the current excel interface (see screenshot below).

I won't bore you with how to download and install it, but I would like to highlight some of the useful features.

I hope you find this tool as useful as I have. As I play around with it more, I'll update this post with any other cool features that I stumble across. Here is the user's guide if you want to learn more about the FRED add-in.

What sort of economics tools, software, or websites do you use to look at economic data? Are there any other excel add-in's out there like this one? I would love to here from you in the comments section below or tweet me with your comment @zack0liver.

I won't bore you with how to download and install it, but I would like to highlight some of the useful features.

- You have over 30,000 economic time series just a click away.

- You can easily update data once new information has been published.

- Data manipulations can be performed on any data set that you download. My favorites are percent change from the previous period and the natural log (I'm finding out in grad school that economists are quite fond of this transformation).

- Ability to change the frequency of aggregation (daily, weekly, bi-weekly, monthly, quarterly, and annual)

- A streamlined graphing process! Other than the actual importing process, I think the graphing feature is my favorite thing in the FRED add-in. I mean, mainly because I can shade US recessions on my graphs for the first time ever. It doesn't get much better than that!

- You can also create a multiple series graph in a matter of seconds and create a secondary vertical axis while you are at it.

|

| Recession shading... |

|

I hope you find this tool as useful as I have. As I play around with it more, I'll update this post with any other cool features that I stumble across. Here is the user's guide if you want to learn more about the FRED add-in.

What sort of economics tools, software, or websites do you use to look at economic data? Are there any other excel add-in's out there like this one? I would love to here from you in the comments section below or tweet me with your comment @zack0liver.

Labels:

data,

technology,

tools

Wednesday, September 7, 2011

Moneyball on the Big Screen

As someone with a personal interest in sports economics, I am looking forward to the new Moneyball movie that is coming out later this month. It is based on the sports classic by Michael Lewis, one of my all-time favorite writers who I have blogged about previously here.

I hope that the movie touches some on the advanced sabermetrics that are used, but I'm assuming there it will just scratch the surface. It's Hollywood after all.

(HT Marion for sharing the trailer with me)

(HT Marion for sharing the trailer with me)

Labels:

Sports

Tuesday, September 6, 2011

Does Maternal Race Impact Adult Outcomes?

Last week, I attended an interesting seminar about a new paper in the works by Peter Arcidiacono and Seth Sanders from Duke University titled Maternal Race and Black Outcomes. Peter Arcidiacono presented the research and did a great job handling a multitude of questions and challenges to the paper. I considered applying to Duke's MA Program, so I was excited to have a Duke professor come to present his work. Anyway, here is the abstract:

1) Although black children with white mothers are demographically more similar to black children with black mothers, black children with white mothers have adolescent and adult outcomes that are more similar to outcomes of white children.

2) Skin tone of the child was insignificant in terms of impact on adult outcomes when maternal race of is accounted for.

3) These results held for a variety of outcomes including wages, college completion, test scores, etc.

As you can see, this paper could likely take a lot of heat simply due to the issue it is trying to tackle. The fact that the mother's racial background is statistically more important than than her child's is a novel idea in this field. Is it culture, social networks and access, the inter-generational impact of discrimination on families, etc. or a combination of many factors? What mechanism is at work here? Here is the authors' conclusion:

Differences between blacks and whites in test scores and labor market outcomes are stark. While much catchup occurred post-Civil rights, convergence has slowed. We examine how differences across education and labor market outcomes vary by maternal race and own race with identification coming from mixed-race families. While black students with white mothers come from families with similar demographics to black students with black mothers, their education and labor market outcomes are very different. There are no significant differences in test scores, grades, college graduation, and wages between black and white males with white mothers, yet large differences exist between these groups and black males with black mothers. These results are insensitive to alternative measures of own-race, using skin tone instead of own race, and including school fixed effects.The paper is somewhat controversial depending on how the results are interpreted. One caveat is that these results are only statistically significant for boys, although girls' outcomes follow a similar pattern. Several major points stuck with me from the seminar.

1) Although black children with white mothers are demographically more similar to black children with black mothers, black children with white mothers have adolescent and adult outcomes that are more similar to outcomes of white children.

2) Skin tone of the child was insignificant in terms of impact on adult outcomes when maternal race of is accounted for.

3) These results held for a variety of outcomes including wages, college completion, test scores, etc.

As you can see, this paper could likely take a lot of heat simply due to the issue it is trying to tackle. The fact that the mother's racial background is statistically more important than than her child's is a novel idea in this field. Is it culture, social networks and access, the inter-generational impact of discrimination on families, etc. or a combination of many factors? What mechanism is at work here? Here is the authors' conclusion:

That fact that the results seem to be different depending upon whether race is coded as race of the mother or race of the child is suggestive that race of the mother may have an affect on outcomes distinct from its effect through the race of the child. This pattern is supported by the findings in this paper which points towards differential investment patterns across mothers of different races.

Labels:

achievement gap,

applied micro,

outcomes

Friday, August 19, 2011

What is an Economist? Tyler Cowen's Version

In a recent interview that Tyler Cowen did with the Economist, there is a segment where he talks about the econ blogosphere. Specifically, he discusses how the blogosphere and the internet is changing the very definition of what it means to be an economist:

I'll be on the lookout for other interesting answers to the question "What is an economist?" and I'll be posting them here. I expect a wide variety of descriptions, including some less than favorable portrayals of the "dismal scientists." If you have your own description of what an economist is (or isn't), share it in the comments section below.

If you look at someone like Interfluidity, known to his mother as Steve Randy Waldman, he is not credentialed the way that Paul Krugman is, but he is a brilliant guy. I think of him as much of an economist or more than any economist. I think partly, the notion of who or what is an economist is breaking down. Take Matt Yglesias, Matt is a philosophy undergraduate major at Harvard. Matt is a way better economist than most economists. It is as if being an economist is this new thing. It’s not just about researching an area for a few years and publishing a paper, it’s about knowing how to twiddle the dials on the internet and learn from this collective thing called the blogosphere, your twitter feed, or other sources that are out there and Matt is awesome at that, and in a funny way is one of the world’s best economists.It is somewhat surprising to hear an academic economist acknowledge that people who are not formally schooled in economics can be better economists than people who have their PhDs. As someone who is planning on getting an MA in economics and working in the private sector, it is refreshing to hear that you don't have to have a doctorate to make a difference in the field.

I'll be on the lookout for other interesting answers to the question "What is an economist?" and I'll be posting them here. I expect a wide variety of descriptions, including some less than favorable portrayals of the "dismal scientists." If you have your own description of what an economist is (or isn't), share it in the comments section below.

Labels:

blogosphere,

technology,

What Is An Economist?

Tuesday, August 16, 2011

Guest Post: Making Sense of the Balanced Budget Amendment

The guest post below is by Andrew Hanson, who blogs regularly over at Amateur Philosophy (you can also follow him on Twitter here.) Andrew is up to date on the DC pulse, and he is a wealth of knowledge about current policy developments. He always brings interesting points to the table, and best of all, he thinks like an economist! I'm thrilled that Andrew has taken the time to write today's guest post on the balanced budget amendment.

Greetings, Zackonomics readers! I'm Andrew Hanson. I'm a fellow 2009 Teach For America alumnus, and I blog at Amateur Philosophy on philosophy, economics, and public policy. Zack and I struggled together while teaching algebra to a quite memorable group of eighth graders.

One of the most interesting aspects of the past five years is how hard-won economic knowledge seems to have been lost by many in the public policy realm, and zombie ideas have again gained influence. Many of these ideas are associated with the Tea Party Movement, which became particularly influential in the 2010 congressional elections. However, they've also gained influence in other conservative and libertarian circles as well. There are many examples. The so-called "Gold Buggers" have called for a return to the gold standard. The Hangover Theory has returned, suggesting that recessions are the punishment we deserve for unwarranted excesses and malinvestment during the boom. Inflation hawks have been crying out in fear of hyperinflation because of the Federal Reserve's decision to "print" more money. The most recent zombie idea is that the federal government is a family that needs to "tighten its belt" when times are tough. The Balanced Budget Amendment, a proposal that would amend the constitution to mandate that the federal government keeps the budget balanced on an annual basis.

Let's focus on the Balanced Budget Amendment, why it's bad economics and bad policy. First, there is a long-term federal budget problem that can only be resolved by cutting health care costs and the Medicare entitlement. But balancing the budget this year and every year after that wouldn't help solve that problem; it would make it worse. To understand why, we have to first think about why the federal government might want to run budget deficits in general. The primary reason the U.S. economy isn't growing is that there isn't enough demand for goods, services, and investments to take advantage of our productive capacity. Factories and workers are sitting idle when they could be engaging in productive activities.

Economists know that recessions are accompanied by a fall in aggregate demand, and though it cannot prevent recessions completely, the federal government can make output and employment less volatile by adopting "automatic stabilizers", changes in fiscal policy that stimulate aggregate demand without policymakers signing any new laws or measures. The tax system, for example, collects less in taxes when output falls because taxes are tied to the level of economic activity: income, earnings, and profits. Government spending, such as unemployment insurance, can also act as an automatic stabilizer. As unemployment rises, the government spends more on unemployment insurance to make up for the lost spending in the economy. More automatic stabilizers, such as tying the payroll tax to the level of unemployment are being proposed now as well.

A Balanced Budget Amendment would require the government to raise taxes and cut spending during a recession, which would further depress aggregate demand, and make the recession longer and far more painful. Instead, the federal government should try to balance the budget over the course of the business cycle, but even that may be asking too much. The federal government never needs to balance its budget completely; it just needs to keep the federal debt as a percentage of GDP at a reasonable level. Kenneth Rogoff and Carmen Reinhardt, economists at Harvard, have detailed exactly what levels are crisis and what countries can afford in their book "This Time It's Different". Their basic conclusion is that anything over 90% of GDP is quite dangerous, while a government could run the federal debt at 50% of GDP basically forever.

Labels:

balanced budget,

budget deficit,

policy

Monday, August 15, 2011

The Paradox of Thrift

It is hard to disagree with the fact that individual thrift is a good thing. However, collective thrift can be a bad thing, as we are seeing right now. Economists call this the paradox of thrift, and the idea is credited to John Maynard Keynes. In the following discussion of this paradox, it is important to distinguish between the short-run and the long-run.

In the short-run, sudden increases in the aggregate savings rate can be harmful to economic growth. We saw this happen during the Great Recession, and it is still and issue right now. According to the BEA, the personal savings rate was 5.4% of disposable income in June of this year. From 2005 to 2007, the savings rate averaged between 1.6% and 2.2% of disposable income (depending on the measure used.) When the savings rate more than doubles in a short period of time, it will be felt throughout the economy.

The pre-recession savings rate turned out to be unsustainable as many people had nothing to fall back on. Since the financial crisis and the related bursting of the housing bubble, consumers have held onto more of their money out of both fear and necessity. The sudden increase in the savings rate that occurred in 2008 is akin to a shock to aggregate demand. A shock to AD decreases national income, which in turn decreases savings despite the increase in the marginal propensity to save. Economist Paul McCulley of Pimco described the paradox like this:

|

| Data from http://www.bea.gov/national/nipaweb/Nipa-Frb.asp?Freq=Qtr |

The pre-recession savings rate turned out to be unsustainable as many people had nothing to fall back on. Since the financial crisis and the related bursting of the housing bubble, consumers have held onto more of their money out of both fear and necessity. The sudden increase in the savings rate that occurred in 2008 is akin to a shock to aggregate demand. A shock to AD decreases national income, which in turn decreases savings despite the increase in the marginal propensity to save. Economist Paul McCulley of Pimco described the paradox like this:

This is an excellent description of the paradox of thrift in the short-run. Essentially, the paradox of thrift says that saving more of your money can be good for the individual, but if we all decide to do it at the same time, it can actually be worse for all of us than if we did nothing at all. This reminds me of game theory's famous prisoner's dilemma. Now, let's shift our view to the long-run.If we all individually cut our spending in an attempt to increase individual savings, then our collective savings will paradoxically fall because one person's spending is another's income--the fountain from which savings flow.

In the long-run, collective thrift (i.e. a higher marginal propensity to save) is a usually a good thing, which is consistent with most people's intuition. To borrow Paul McCulley's lingo, savings are the fountain from which investment flows, assuming people aren't simply hoarding money.

So, what can we do about the the paradox that we face? My conclusion is that policymakers should encourage consumers to avoid having extremely low savings rates during economic expansions. Yes, low savings rates can stimulate growth in the short-term since more money is being quickly funneled back into the economy via consumption. However, low savings rates are counter-productive in the long-run. We still live in a world with business cycles, and when recessions rear their ugly heads, individuals and households need a financial buffer. When someone loses a job, past savings can be shifted to cover bills and living expenses if needed. In addition to individuals having this essential buffer, higher collective savings over the long-run are good for the economy since savings is the mechanism for investment. Policymakers can help over the long-run by limiting uncertainty and maintaining trust, so that savings are invested productively.

While the paradox of thrift does have some valid criticisms (here and here), it is an interesting concept that has important implications for our economy.

Saturday, August 13, 2011

Graduate School

I am officially a graduate student in economics! Just over one week ago, I started my Master's degree in Applied Economics. The two tracks that I am deciding between are "Data Analytics" or "Applied Micro and Policy". I would love to do both of them, but the program is only three semesters long, so my capacity is limited.

Unfortunately, I have not been posting to the blog much lately due to the fact that I have been in the process of relocating to a new city for my graduate program. However, my goal is to post at least 3 to 4 times per week by the end of the the year, and writing that here will hopefully be an effective commitment device!

Now, I should get back to studying for my three-week Math Econ course. The Cobb-Douglas production function, Taylor's Theorem, and Hessian matrices await!

Look for posts soon... and don't forget to follow me on Twitter as an easy way to get updates for this blog.

Unfortunately, I have not been posting to the blog much lately due to the fact that I have been in the process of relocating to a new city for my graduate program. However, my goal is to post at least 3 to 4 times per week by the end of the the year, and writing that here will hopefully be an effective commitment device!

Now, I should get back to studying for my three-week Math Econ course. The Cobb-Douglas production function, Taylor's Theorem, and Hessian matrices await!

Look for posts soon... and don't forget to follow me on Twitter as an easy way to get updates for this blog.

Saturday, July 30, 2011

Monetary Economics Links

With the United States debt ceiling debate coming to a head, the recently released downward revisions of GDP data from the last few years, and talk of a second recession (or that there was never a recovery in the first place), I have been reading more than usual about monetary policy and macroeconomics. Here are some articles, posts, and other stuff I have been reading and found interesting enough to share here.

The "little depression" just got bigger by Brazilian economist Marcus Nunes

Recessions compared by GDP % change and employment % change

Greg Mankiw thinks Bernanke and the Fed have done a decent job

Scott Sumner on thinks Mankiw was too easy on Bernanke and that he should work for the Fed

Tim Harford's clever debt ceiling analogy

A letter to Timothy Geithner on what could happen if the debt ceiling isn't raised

NPR Planet Money Podcast: Would US credit rating downgrade matter?

Matt Yglesias on the difference between Inflation Targeting vs Price Level Targeting

Paul Krugman thinks more government spending is needed (I disagree, for long term concerns. Perhaps the optimist in me believes there are other ways to stimulate the economy... For starters, how about addressing all of the uncertainty related to the debt ceiling debate.)

Paul Krugman rips on the Maestro

Update: Tyler Cowen defends Greenspan

Apple has more cash in reserves than the US Treasury (this isall over the place a popular news story right now, but still amazing)

Update: A somewhat pessimistic view of the Sunday debt deal by Ezra Klein

I realize this compilation is somewhat all over the place, but it is worth reading.

The "little depression" just got bigger by Brazilian economist Marcus Nunes

Recessions compared by GDP % change and employment % change

Greg Mankiw thinks Bernanke and the Fed have done a decent job

Scott Sumner on thinks Mankiw was too easy on Bernanke and that he should work for the Fed

Tim Harford's clever debt ceiling analogy

A letter to Timothy Geithner on what could happen if the debt ceiling isn't raised

NPR Planet Money Podcast: Would US credit rating downgrade matter?

Matt Yglesias on the difference between Inflation Targeting vs Price Level Targeting

Paul Krugman thinks more government spending is needed (I disagree, for long term concerns. Perhaps the optimist in me believes there are other ways to stimulate the economy... For starters, how about addressing all of the uncertainty related to the debt ceiling debate.)

Paul Krugman rips on the Maestro

Update: Tyler Cowen defends Greenspan

Apple has more cash in reserves than the US Treasury (this is

Update: A somewhat pessimistic view of the Sunday debt deal by Ezra Klein

I realize this compilation is somewhat all over the place, but it is worth reading.

Labels:

debt ceiling,

macro,

recession,

recovery

Wednesday, July 20, 2011

Tim Harford on The Importance of Trial and Error

This TED Talk by economics writer Tim Harford is a snapshot of his new book, Adapt: Why Success Always Starts with Failure . If you find the talk interesting, I would highly recommend reading the book, which was thought-provoking and interesting throughout.

. If you find the talk interesting, I would highly recommend reading the book, which was thought-provoking and interesting throughout.

Friday, July 8, 2011

Corporate Profits Recover as Individuals Struggle

While corporate profits are recovering nicely, wages and salaries are stagnant. Check out recent posts at the Curious Capitalist here and Freakonomics here about how the current economic recovery strongly favors corporations and stockholders. The posts are based on this study from Northeastern University. The Great Recession differs greatly from recessions of the past, as does the current recovery.

Hopefully, the recovery of jobs and wages will come with time, but how long this lag will be is debatable. Keep in mind, this recession was largely due to the sub-prime mortgage crash - and resulting drop in home values - which is very different from prior recessions.

To date, through the first quarter of 2011, the nation’s recovery from the 2007-2009 recession is both a jobless and a wageless recovery. (p. 23)And here is a table comparing the current recovery to previous ones. (click to enlarge)

| |

| Center for Labor Market Studies, Northeastern University (p. 20) |

Monday, July 4, 2011

Signs of Economic Progress: China

In a recent discussion with a relative who does extensive business with the Taiwanese and Chinese, he talked about the changes he has witnessed occurring in China over the last decade. One story in particular stuck with me.

In a town in mainland China, there is a nice restaurant that he visits with his business partners on each trip. Ten years ago, the clientele were 90% Tiawanese and 10% Chinese. Now, he says, the clientele are 90% Chinese and 10% Tiawanese!

Although this is anecdotal evidence, and some of the changes could be due to changing demographics in the area, I think that this is also a sign of rising wages and a growing Chinese middle class. As a result of opening itself up to foreign investment and international trade, China continues to be one of the fastest growing economies in the world. Next step for the Chinese government, human rights.

In a town in mainland China, there is a nice restaurant that he visits with his business partners on each trip. Ten years ago, the clientele were 90% Tiawanese and 10% Chinese. Now, he says, the clientele are 90% Chinese and 10% Tiawanese!

Although this is anecdotal evidence, and some of the changes could be due to changing demographics in the area, I think that this is also a sign of rising wages and a growing Chinese middle class. As a result of opening itself up to foreign investment and international trade, China continues to be one of the fastest growing economies in the world. Next step for the Chinese government, human rights.

Labels:

Signs of Economic Progress

Monday, June 27, 2011

Geopolitics of the Arctic

The geopolitical and economic implications of a receding Arctic icecap are something to keep an eye on. Global warming is old news to most, but I found this specific instance noteworthy.

The time-frame in the summer when the Arctic waters are passable by ship appears to be increasing. This is a big opportunity for shipping companies to cut down on transportation costs. The video below from the Economist touches on shipping, fishing, and the possibility for more offshore drilling. I am somewhat skeptical about the extent that drilling would be cost efficient in these waters given such a small window of time and the high fixed costs for drilling. Also, staunch opposition from environmentalists will make it politically difficult for oil companies to drill in this area. However, assuming that the melting trend continues, this area could become a hotbed for international conflict over the next century as countries and oil companies jockey for position in the region.

Labels:

economics,

geopolitics

Thursday, June 9, 2011

When a Weak Dollar Is Good for the US

The NY Times reports that the trade deficit has shrunk. One of the main reasons has to do with the dollar:

In recent months, a weaker dollar has made goods from the United States less expensive overseas, while exports have also climbed in price as demand rose in developing countries.

Monday, June 6, 2011

Economic Reflections by Music Industry Experts

|

| Warner/Chappell Music |

Technology has made [entrepreneurship] possible, the economics have made it mandatory.This quote is from Ron Routson, COO of Film House, about the role entrepreneurship has been playing in the industry. The quote is to the point and captures what has happened in the industry over the last decade.

Some people say owning a studio is like owning a boat... the two happiest days are the day when you buy it and the day when you sell it.The second quote came from Patrick McMakin Sr. who is the Director of Operations of Belmont University's Ocean way Nashville Recording Studios. I enjoyed the humor here, but it also speaks to just how difficult it is to run a studio profitably. I always had the impression that studios were super profitable, but with high overhead costs and more people recording themselves at home, keeping a studio above breakeven is difficult, according to McMakin.

Looking forward to Day 2 with more music business experts tomorrow.

Subscribe to:

Posts (Atom)